PRODUCT FOCUS AND EXAMPLES

Example – Utilising the Corporate Guarantee risk management structure in your business cycles

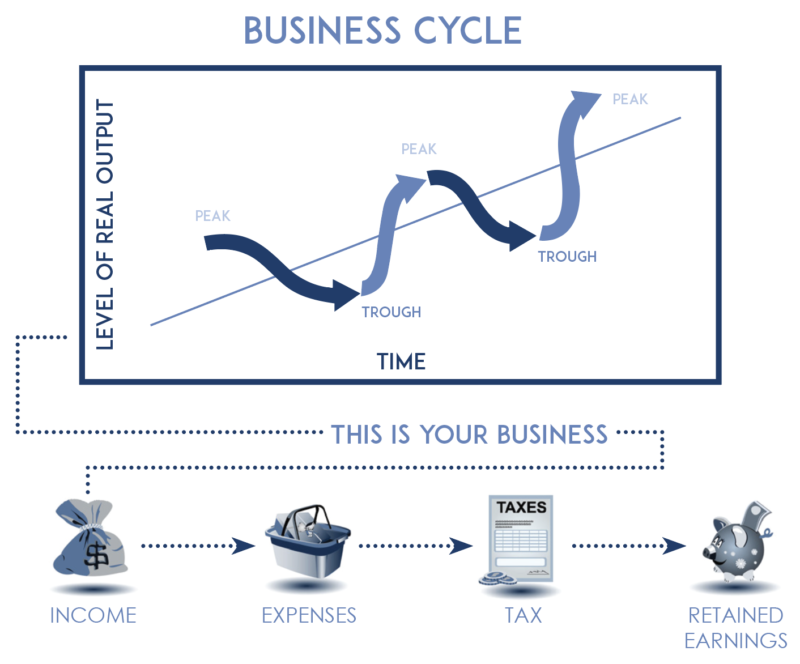

Traditionally businesses make use of conventional methods to manage their risks that they have generally considered uninsurable. For example, using retained earnings to cover potential future losses.

The Corporate Guarantee Alternative Risk Transfer product, also known as the Contingency Policy, is an alternative to conventional insurance policies. We assist you in converting risks into sustainable wealth by making use of a risk management policy. Corporate Guarantee also provides a standard additional cover of 20% on all policies in catastrophic events. This risk management policy will offer long and short-term advantages that will give your business a second breath during the downside of your business cycle or in a catastrophic event.

By utilising a risk management policy, companies can purchase cover for their business. This cover will then be available to manage their specified risk as well as assist the company during periods where the business potentially experiences losses or difficult economic conditions. The risk management policy can thus smooth out the financial impact of unpredictable events and can assist companies to stabilise their business cycle.

Example – Combining Conventional Insurance with Corporate Guarantee

For illustrative purposes, let us say you are currently paying N$50 000 per month for your conventional insurance, to cover N$6 000 000 worth of risks in your business. You want to purchase a risk management policy with Corporate Guarantee to assist in managing some specific risk in the future. One way to structure this transition, is to increase your current excess payment and save the difference between your current premium and the new reduced premium by purchasing your risk management policy with Corporate Guarantee, as shown below:

| Current Situation | |

| Risk Covered | N$ 6 000 000 |

| Conventional Monthly Insurance Premium 1 | N$ 50 000 |

| Current Excess | N$ 5 000 |

| Corporate Guarantee Combination Alternative | |

| Risk Covered | N$ 6 000 000 |

| Increase Excess to | N$ 20 000 |

| Conventional Monthly Insurance Premium 2 | N$ 30 000 |

| Monthly Saving on Conventional Insurance | N$ 20 000 |

The annual savings from your conventional insurance premium reduction in the example will amount to N$240 000. These savings can then be used to purchase risk management cover from Corporate Guarantee. This cover can then be allocated towards the increased excess payment as well as additional risk in your business.

*This example is for illustrative purposes only and does not constitute financial advice.

CONTACT US