ABOUT ALTERNATIVE RISK TRANSFER (ART)

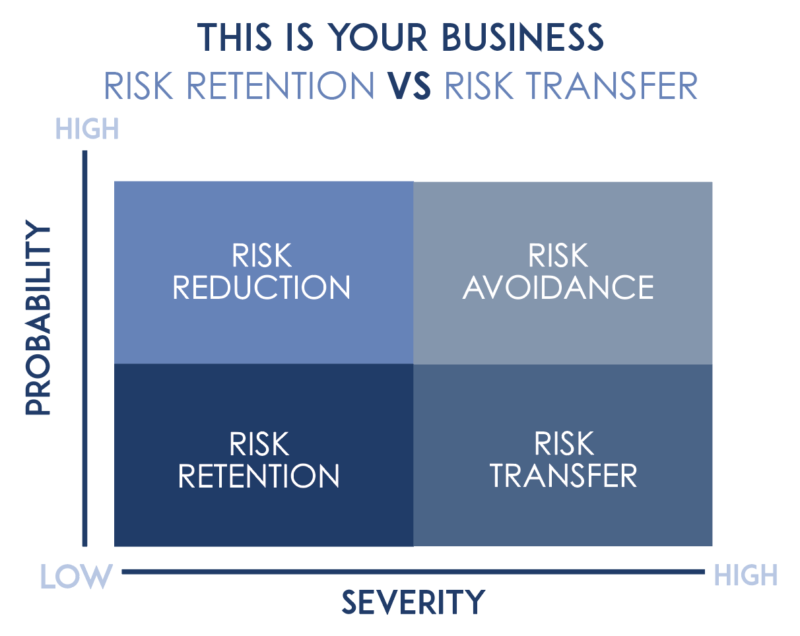

Each business has various types of risks, that they need to identity and navigate. When assessing these risks, we mainly look at the probability of occurrence as well as the impact they are likely to have on your business. For instance, an event that has a low probability of occurring, may have a significant impact on your business, thus high severity, and therefore it may be better to transfer this risk. An example of this may be fire insurance on a building. The chances of a fire occurring might be low, depending on the mitigating factors and precautions implemented, but if the building burns down it can have a severe impact on your business. Thus, the client may select to cover this risk through conventional short-term insurance.

Risks may have dissimilar probabilities as well as different severities and this can vary from client to client. It is therefore crucial to assess each client’s risk and then subsequently determine the most appropriate measures to implement. Certain predictable risks in your business may be more beneficial to retain. This is where Corporate Guarantee can assist you, by both identifying and managing these risks, in a cost-effective manner using a Contingency Policy. By retaining these risks, you can potentially save on your short-term insurance costs and in the long-term convert your risks into sustainable wealth.

• Determine your insurance structure – in partnership with us

• Decide which risks to insure and how you would like to allocate the premium that you have purchased

• Receive 20% additional cover of total premiums purchased in catastrophic events, to assist you in managing your risk. The amount of cover provided can also be increased to meet your individual needs.

• The Insured is rewarded for good risk management and can share in underwriting profits

We assist you to assess:

• The risks that are part of your operation

• The amount of cover you might need

• How to efficiently combine your existing conventional cover with Corporate Guarantee’s risk management policy

You can use your contingency policy, to either:

• Comprehensively cover your insurance risks

OR

• Supplement your existing conventional insurance

Corporate Guarantee assists each client to create a customised insurance solution. Contact us today to schedule an obligation free appointment and start your journey towards optimised risk management and financial independence.

CONTACT US