ABOUT ALTERNATIVE RISK TRANSFER (ART)

What exactly is risk?

As a business owner, you may be unsure which risks you should retain and which ones you best avoid or transfer.

This is where Corporate Guarantee comes in, by assisting you in both analysing and optimising your risk management process.

Contingency Policy

The Alternative Risk Transfer (ART) contingency policy is a short-term insurance policy. It is a sensible alternative for clients with a long-term, personal commitment to property loss prevention, a serious focus on loss control and a willingness to assume a portion of their own risk. One of the benefits gained from the implementation of the policy, is to potentially reduce the cost of conventional insurance premiums. Premiums paid towards the risk management policy are allocated according to the risk specified on the policy. Any surplus premiums not claimed during the period are either returned to the client or transferred to the following underwriting year. The benefit to the client being that the product offers a dedicated risk management structure, by providing a wider scope of risk cover categories, where conventional insurance companies might have been either unwilling to provide cover or it was too expensive to obtain cover at appropriate levels.

Contingency policies have become a must-have tool for risk managers globally and account for a substantial amount of international insurance premiums.

What we offer

Credit Insurance

Income Protection Policy

ADVANTAGES OF THE PRODUCT

The cash value of your policy can be pledged as security to access a loan facility to enhance your cashflow OR the issuing of guarantees, if needed.

ACCESSING MY POLICY

In the case of a claim

Claims can be made against the policy up to the value of the Policy Indemnity Limit (PIL). Claims can be paid out within 24 hours

In case of a reduction in cover:

Insurance cover can be reduced through a downward endorsement of your policy. Downward endorsements carry a 0.5% fee and can be paid out within 24 hours.

At expiry of the policy:

The policy normally expires after a period of 12 months. Any cover that is not utilized during the current policy term, can be used for future risk management. Alternatively, the experience bonus can be paid out to the client for good risk management.

Cancellation of the policy:

The insured may cancel the Contingency Policy at any time. Corporate Guarantee requires a 30-day notice period.

PRODUCT FOCUS AND EXAMPLES

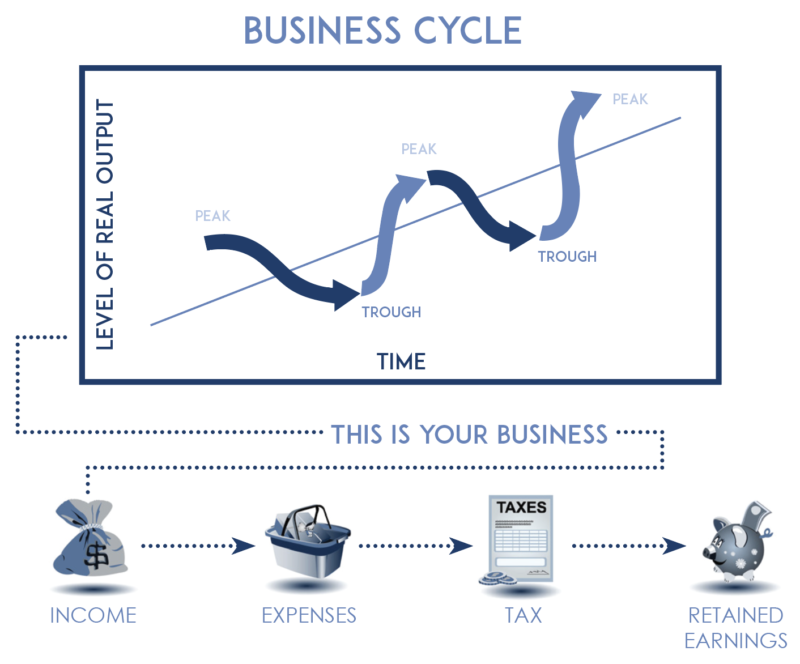

Example – Utilising the Corporate Guarantee risk management structure in your business cycles

Traditionally businesses make use of conventional methods to manage their risks that they have generally considered uninsurable. For example, using retained earnings to cover potential future losses.

The Corporate Guarantee Alternative Risk Transfer product, also known as the Contingency Policy, is an alternative to conventional insurance policies. We assist you in converting risks into sustainable wealth by making use of a risk management policy. Corporate Guarantee also provides a standard additional cover of 20% on all policies in catastrophic events. This risk management policy will offer long and short-term advantages that will give your business a second breath during the downside of your business cycle or in a catastrophic event.

By utilising a risk management policy, companies can purchase cover for their business. This cover will then be available to manage their specified risk as well as assist the company during periods where the business potentially experiences losses or difficult economic conditions. The risk management policy can thus smooth out the financial impact of unpredictable events and can assist companies to stabilise their business cycle.

Example – Combining Conventional Insurance with Corporate Guarantee

For illustrative purposes, let us say you are currently paying N$50 000 per month for your conventional insurance, to cover N$6 000 000 worth of risks in your business. You want to purchase a risk management policy with Corporate Guarantee to assist in managing some specific risk in the future. One way to structure this transition, is to increase your current excess payment and save the difference between your current premium and the new reduced premium by purchasing your risk management policy with Corporate Guarantee, as shown below:

| Current Situation | |

| Risk Covered | N$ 6 000 000 |

| Conventional Monthly Insurance Premium 1 | N$ 50 000 |

| Current Excess | N$ 5 000 |

| Corporate Guarantee Combination Alternative | |

| Risk Covered | N$ 6 000 000 |

| Increase Excess to | N$ 20 000 |

| Conventional Monthly Insurance Premium 2 | N$ 30 000 |

| Monthly Saving on Conventional Insurance | N$ 20 000 |

The annual savings from your conventional insurance premium reduction in the example will amount to N$240 000. These savings can then be used to purchase risk management cover from Corporate Guarantee. This cover can then be allocated towards the increased excess payment as well as additional risk in your business.

*This example is for illustrative purposes only and does not constitute financial advice.

FREQUENTLY ASKED QUESTIONS

Furthermore, there is a 1% Stamp Duty levy, with a maximum charge of N$ 250, which is applicable on each new premium bought at Corporate Guarantee.

There is a No Claims Bonus (NCB)* section at the bottom of the Experience Account statement which shows the notional interest earned to date. Please remember that the interest is capitalized at the end of the 12-month insurance period.

2. Should the policy be bought and paid over a 12-month period the Debtor Account Statement reflects the premium due on your policy.